Make this year your best financial year!

If you’re looking to boost your income, then working as a locum is a great way to do that. By taking one (or possibly two) years to locum is a great opportunity to put your finances in order, but with it, comes financial implications that you may not have considered previously.

Don’t overwhelm yourself with managing your finances too much though, it’s quite simple really…. One of the main differences when working as a locum is that instead of deductions being automatically taken from your regular monthly salary, you must manage the submission of your timesheets yourself. This will often result in the need to take a more active role in ensuring your tax, national insurance and pension contributions are accurate.

In this guide, we will delve deeper into some of the most important things you should be looking out for as a new locum doctor.

If you are registered, Holt Doctors supports you through the process, offering knowledgeable advice regarding your tax, national insurance, pension and how a hospital locum is paid. We will help you make sense of managing your locum finances and if you’re still a little bit stuck, rest assured, your dedicated Recruitment Consultant will always be around to assist.

As a locum, you’ll need to contemplate your tax position and by getting a better understanding of the financial aspects of locum work, you can avoid ending up with a large tax bill at the end of the year - this goes for national insurance and pensions too.

Hospital Locum - How you will be paid

Currently, if you’re a junior doctor, there are two main ways you will be paid, and we will discuss these in a minute.

The simplest way of setting yourself up to work with the NHS, without being employed in a substantive post, is to work through a locum agency.

The two ways you can be paid:

PAYE ‘pay as you earn’ through a Trust is a common method by which locums are paid. You will still be paid by the Trust on their payroll (paying full PAYE and National Insurance contributions) and the amount of tax payable is taken care of.

Agencies refer to this as ‘direct engagement’ and if you work at such a hospital, you will have to complete the Trust’s own timesheets and follow their payment procedure.

PAYE through the agency is when locum agency firms offer to pay you through their own payroll as an Agency PAYE worker.

Don’t worry though, your dedicated Holt Recruitment Consultant will guide you through either process and provide you with all the information you will need, so you can be sure you are paid smoothly and quickly.

Understanding your tax codes

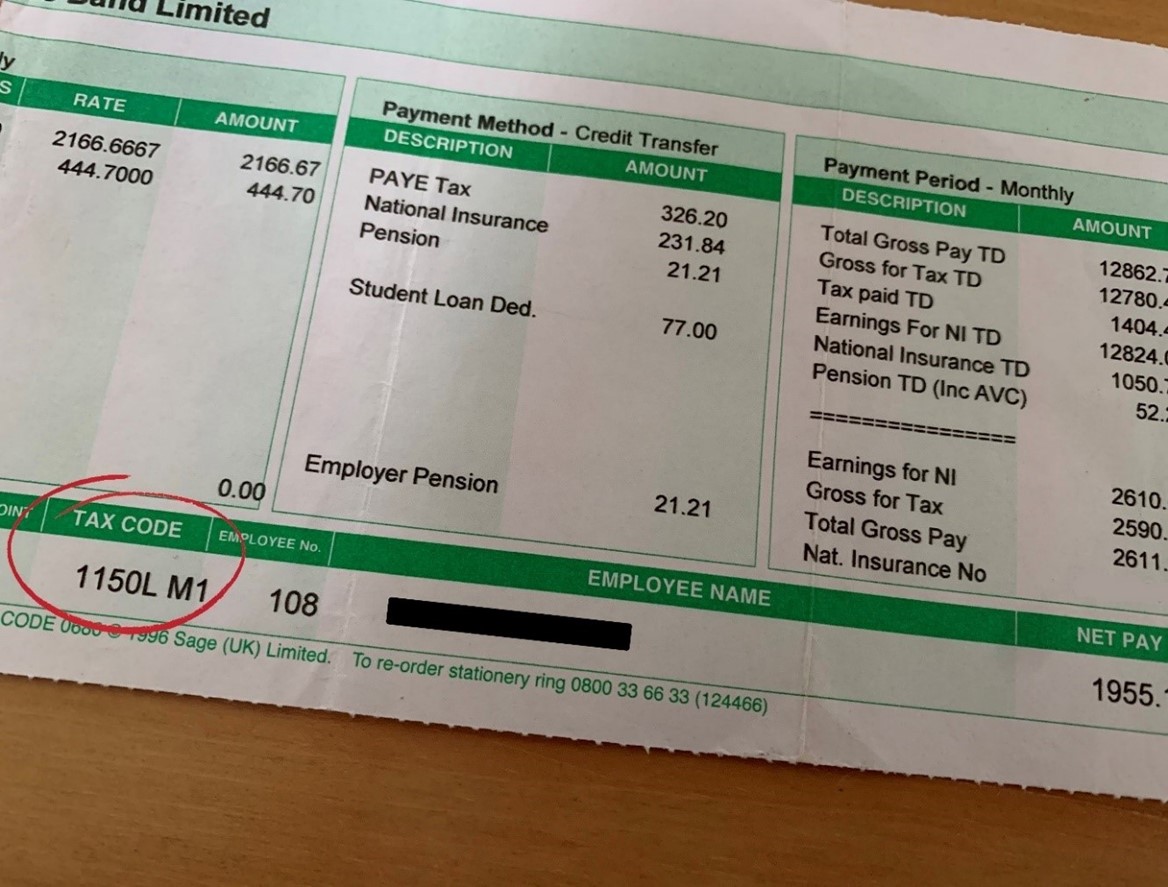

The UK’s tax system can be a little complicated and confusing at times, understanding your tax code is important. Your tax code can be found on your payslip, under the box that says; ‘tax code’. Your tax code will usually be made up of letters and numbers, see below:

The number on the tax code is normally the amount, in £, that you can earn before any tax is due, divided by 10.

Your tax code is provided by HMRC (HM Revenue and Customs) to inform your employer and enable the payroll team to calculate how much income tax you should pay.

If you only have one job and no extra income or allowances altering your code, for 2021 to 2022, your basic Personal Allowance will be £12,570 (which is the amount of income you do not have to pay tax on). The threshold (starting point) for PAYE is, therefore, £242 per week (£1,048 per month). The standard tax code for the 2021 – 2022 year is 1257L.

What income tax band am I in?

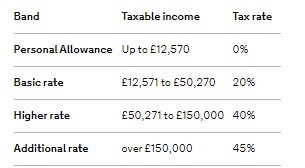

Once you know what your personal allowance is, anything extra earned above that will be subject to income tax. For the 2021/22 tax year (if you live in England, Wales or Northern Ireland), there are three marginal income tax bands:

- Basic rate - 20%

- Higher rate - 40%

- Additional rate - 45%

Remember, your personal allowance starts to decrease once earnings hit £100,000.

Marginal bands mean you only pay the specified tax rate on that portion of your salary. For example, if your salary puts you in the 40% tax bracket, you only pay 40% tax on the segment of earnings in that income tax band - For the lower part of your earnings, you will still pay the appropriate 20% or 0%.

If you’re living in Scotland, there are five marginal income tax bands:

- Starter rate - 19%

- Basic rate - 20%

- Intermediate rate - 21%

- Higher rate - 41%

- Additional rate - 46%

It’s not unusual for HMRC to tell your payroll department to apply an incorrect tax code, which can be a major issue for doctors. For example, if you decided to change jobs in, let’s say, February, you’re supposed to receive a payslip from your old employer and your new employer, which confuses HMRC into thinking that you have two jobs.

If HMRC are unsure (or they require further information), they will apply what’s called an emergency tax code, which results in your tax-free personal allowance being taken away.

You might see the following on your payslip:

- BR - This will automatically tax all of your income at the basic rate of tax (currently 20%) with no personal allowance being taken into consideration, and therefore results in a higher income tax bill.

- D0 - This does the same as above, but taxes all income at the higher rate of 40%

- 0T - is a so-called ‘Emergency Tax Code’, which again applies the basic rate with no personal allowance deducted.

Please note, different income tax rates may apply in Scotland.

If you’re a locum doctor, this problem may arise if you have multiple employers. Make sure you keep a close watch on this. If your tax code is wrong, this could be a costly error (albeit only temporary) - losing your tax-free personal allowance will unavoidably result in higher tax bills until the tax code is amended.

Paying Tax

When to pay tax really depends on how you have been set up as a locum. Most locum doctors are employees of Trusts, even if you work through an agency. Via PAYE, the agency or Trust you work for should apply your tax code and deduct tax, National Insurance, pension, and student loans each month.

Self-Assessment is a system HMRC uses to collect Income Tax. If you have another income, you must report it in a tax return. If you need to send one, you fill it in after the end of the tax year (5 April) it applies to. HMRC will calculate what you owe based on what you report. Make sure you pay your Self-Assessment bill by 31 January, this is the deadline for filing the tax return.

The key to managing your finances as a locum is to be organised from the start. Make sure you keep a record of income and expenses throughout the year, this will make gathering the information if you need to do a Self-Assessment tax return a lot easier!

Claiming Tax Back on Expenses

Even if you are employed through PAYE some of your expenses as a doctor should still be tax-deductible. If you’re a junior doctor, you can claim tax back on GMC, BMA, MDU, MPS, Royal college and examination expenses amongst other professional expenses.

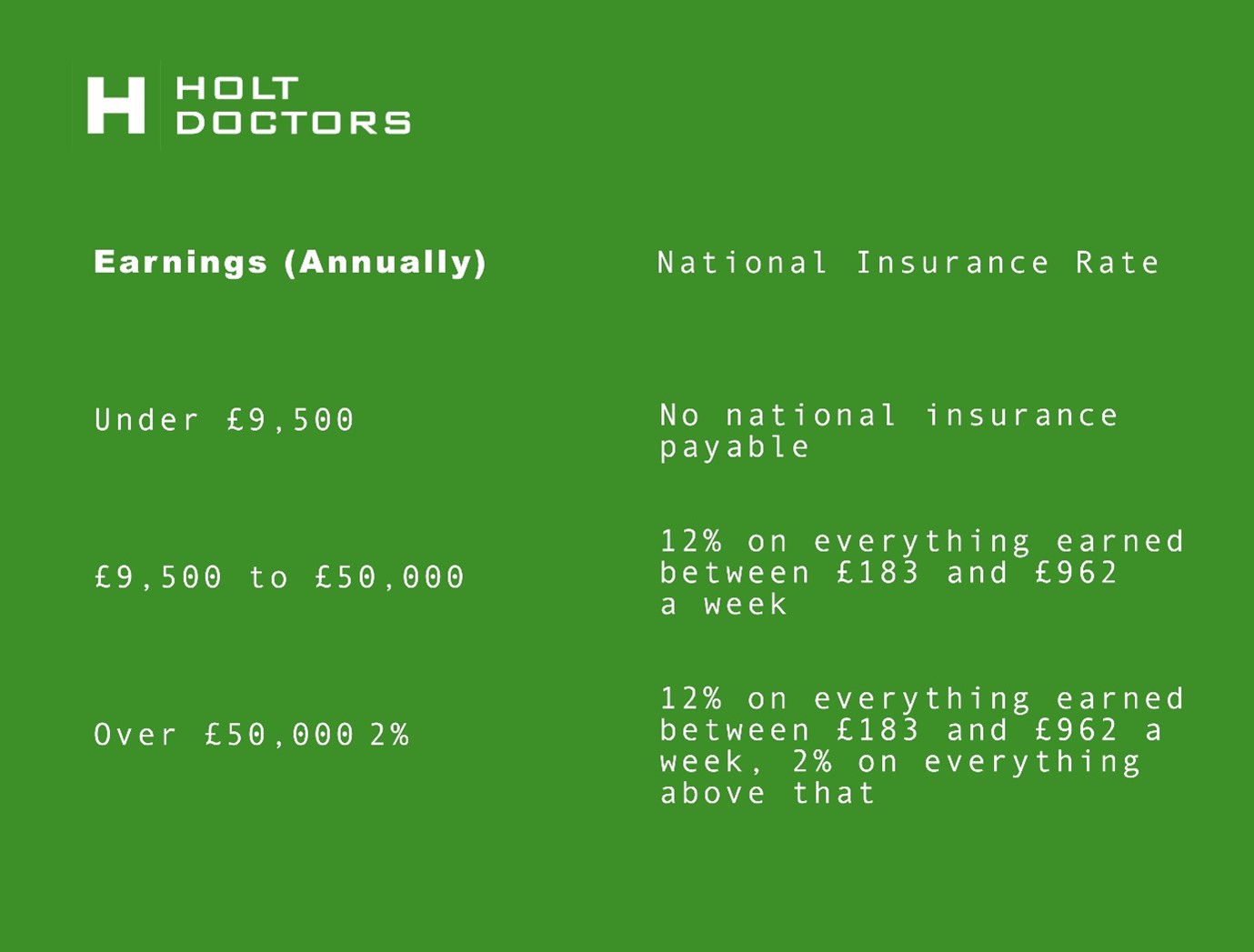

National Insurance

National Insurance is quite complex, so we won’t go into too much detail! If you’re a locum and have more than one job in the tax year, employees need to keep a close eye on your National Insurance Contributions.

There are 4 classes of National Insurance contributions:

- Class 1 - payable by employees and employers - paid via PAYE - so you earn your pay net.

- Class 2 - payable by the self-employed (flat rate) - payable on the issue of a bill or by direct debit

- Class 3 - voluntary contributions (not relevant, if you’re a doctor)

- Class 4 - payable by the self-employed (profits based) - payable via your self-assessment return.

If you’re a doctor with a salaried appointment and some freelance work, you could be paying Classes 1, 2 and 4.

NIC (National Insurance Contributions) is charged against salaries for employed doctors and against profits for self-employed individuals.

The key thing to remember is the rates are charged on total amounts. As a locum, you may work for multiple people and they may charge you as if that job was your only one for NIC.

If you have a feeling you’ve overpaid NIC you can always contact the National Insurance Contributions Office for help. If there’s been a mistake and overpaid, they will give you a refund.

This may be the case for the second example too if you have both an employed and self-employed income. It’s not the income received that matters, it’s the total.

Pension aware

Pension contributions will be deducted at source (like your tax) and dealt with by the trust if you’re a hospital locum paid via the hospital payroll.

If you want to opt-out of the NHS pension scheme and not pension your earnings, you can, but it may have a negative impact on your financial pension’s benefits (for example, losing your employer contributions and ‘death in service’ benefits), so have a think about this beforehand.

If the Trust you are working for offers a pension scheme benefit, there are limits on the number of pension benefits you can have without incurring additional tax - More information about this can be found on the NHS Pension Scheme website.

Medics’ Money (a doctor-led organisation that empowers doctors to make better financial decisions) has a great blog on the NHS pension scheme. Have a quick read through for further guidance here.

If you're with an agency like Holt Doctors, we handle all the relevant pension contributions for you and let you know your pension position and contributions.

To summarise

Taking care of your taxes may seem difficult and a little daunting, but if you follow our advice everything should be smooth and simple. See below a summary of our top tips:

- Determine how you want to be paid (most doctors choose PAYE through direct engagement)

- Keep a close watch on your tax code and call HMRC if you think there are any problems.

- Keep organisations such as HMRC and the Student Loans Company updated with your employer’s details

- Check your NI contributions if you have more than one employer, make sure you’re not overpaying.